Introducing ZKstats.io

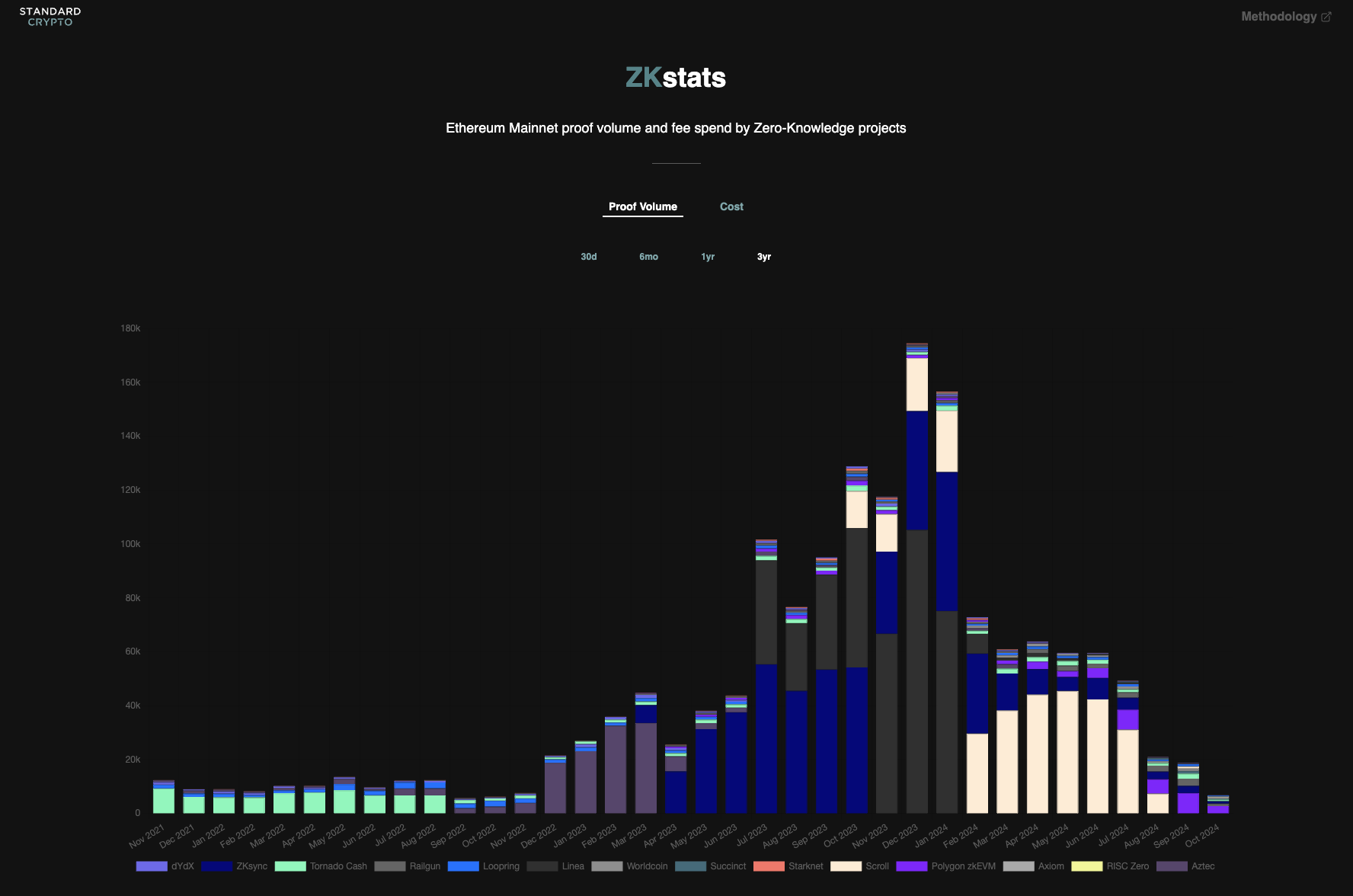

We built ZKstats.io, a simple resource to track per-project spending and volume for verifying Zero-Knowledge (ZK) proofs on Ethereum Mainnet. We hope these metrics are useful for monitoring the health and growth of individual projects, as well as the broader ZK ecosystem.

Our engineering team built a dashboard (zkstats.io) to track the volume and verification costs of Zero-Knowledge (ZK) proofs submitted to Ethereum Mainnet.

We hope this tool is helpful for the community to monitor the growth of individual projects and the ZK ecosystem at-large.

One pattern we identified while building this dashboard was a series of efficiency upgrades in ZK rollups. This trend consists of an initial period where proof volume and L1 gas spend increase, followed by a protocol upgrade that results in a reduction in gas spend (usually dramatically!) and proof volume.

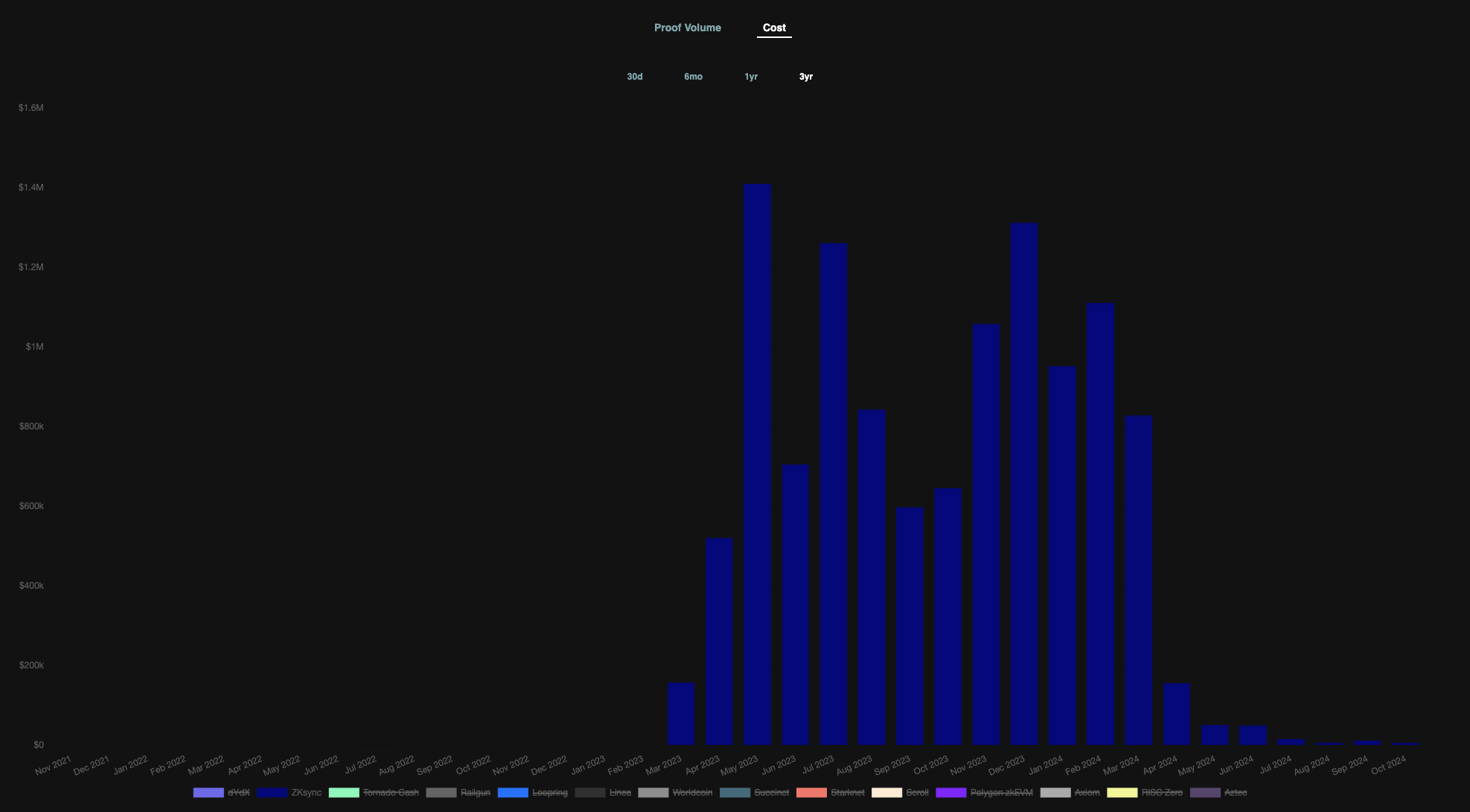

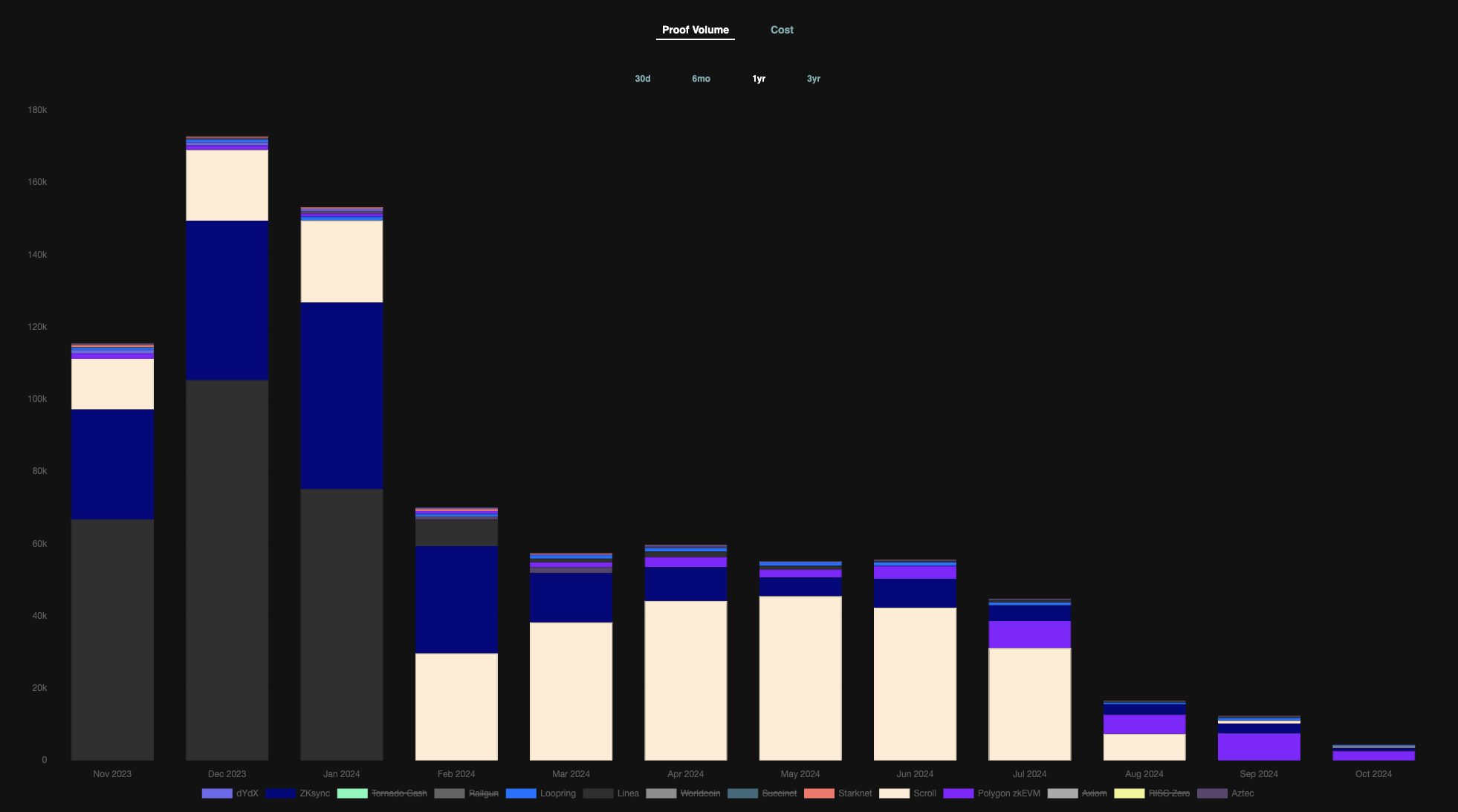

An example of this trend is Linea, which launched in July 2023 and saw its gas spend peak at over $12M in December 2023, partially driven by its Voyage XP program. After Linea’s Alpha V2 upgrade in February, gas spending dropped to approximately $500K and has since remained under $200K per month.

Some projects have had multiple efficiency upgrades. In addition to reducing costs, these upgrades often lead to broader ecosystem improvements, such as improved decentralization or lower fees for users. More efficient proving mechanisms can enable broader participation by reducing hardware requirements, allowing a wider range of contributors to participate in the network, thereby enhancing scalability and decentralization.

ZKsync Era has had at least 3 such upgrades. The first upgrade was the launch of the Boojum proof system, which lowered gas fees from $1.3M in December 2023 to under $1M in January while proof volume increased. The second upgrade, in March 2024, aligned with EIP-4844 (Proto-Danksharding) and reduced fees by a factor of 10, leading to a cost reduction of about 5x. The latest upgrade, the v24 protocol upgrade, further reduced costs by approximately 3x. Each iteration of this cycle brought improvements to the protocol, including support for secure hardware devices, making transaction signing easier and more secure, which in turn enhanced the user experience.

Another trend identified is the impact of Proto-Danksharding on the ZK rollup landscape as a whole. Proto-Danksharding allows rollups to store larger amounts of data on Ethereum more efficiently, significantly reducing the costs for rollups to post transaction data on-chain. While this change made data storage cheaper, it did not affect the cost of running ZK circuits to attest to the stored data. However, many projects experienced a reduction in both proof volume and gas expenditure immediately following the upgrade.

In some cases, this can be attributed to protocol upgrades made in anticipation of EIP-4844, which also enhanced the efficiency of proof mechanisms. Even when proof mechanisms remained unchanged, the ability to store data in larger bundles (blobs) allowed projects to commit more transactions at once, reducing proof volume and, consequently, gas costs.

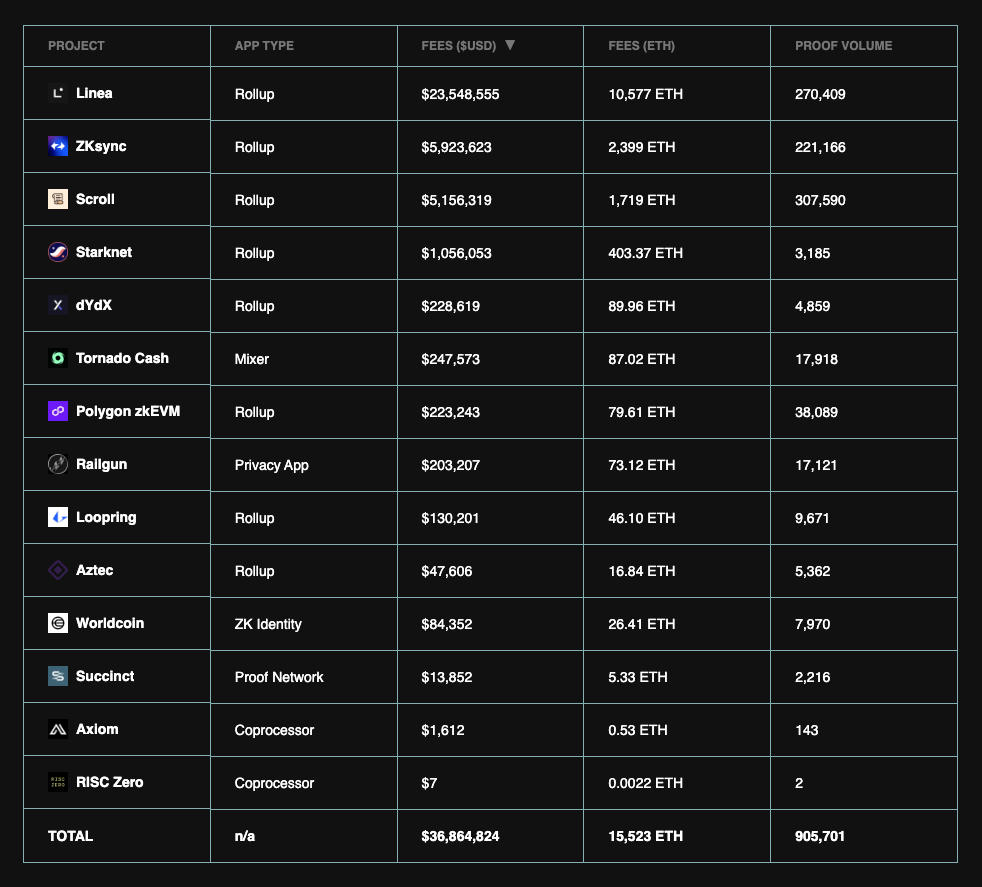

The most common use of ZK proofs on mainnet is for validating state transitions from L2s, which scale the volume of transactions posted to L1. The proof volume and spending by these L2s far exceed the amounts spent by other applications using ZK on mainnet. These other applications vary, but often focus on privacy. The data collected so far shows that these projects are still early in their adoption.

Check out our documentation for a full list of projects and details on how the data was collected.

While we’ve certainly missed some ZK projects, we hope this serves as a helpful starting point for monitoring the ecosystem. If you’re a project that would like to be added to the dashboard, or an existing project with feedback or requested corrections, please reach out at kevin@standardcrypto.vc.

We’d also like to thank Nebra for helping develop the queries that support this project.