Pooling in OP_CAT's World

on

TL;DR: counter to popular discourse, we argue that upgrades to Bitcoin - such as the BitVM, OP_CAT, or OP_CTV - will stabilize Bitcoin consensus. By opening up new miner fees and reducing reliance on extractive pooling schemes, additions to Bitcoin will create network sustainability, push miners away from more dangerous forms of expressivity, and help Bitcoin maintain its lead in stability without injecting rivalrous or centralizing forms of revenue.

A healthy mining market is vital to the longevity of Bitcoin. Last year amidst low blockspace demand, Bitcoin’s biggest miners began to merge mine for extra fees. While exploration has its place, this hints that without issuance, miners in dire need of revenue will destabilize or centralize Bitcoin with worse forms of expressivity.

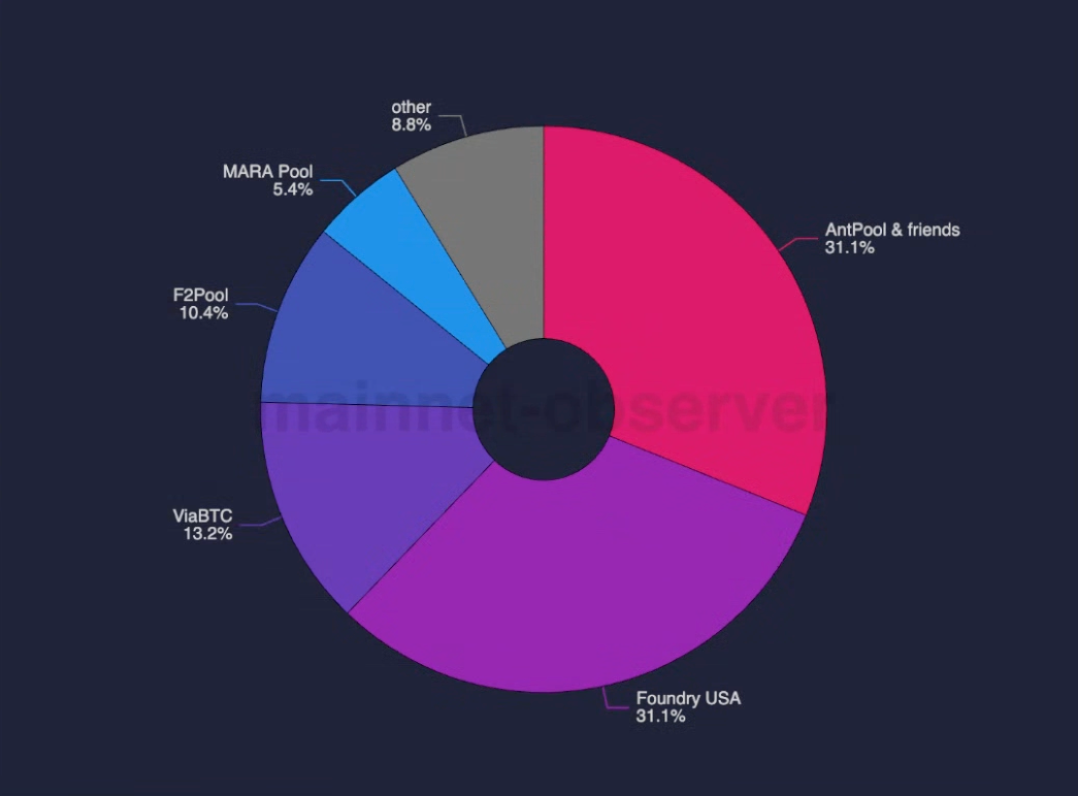

Given this, how would forms of expressivity alter prospects for stability? In particular, how would expressivity and fees change mining, which is dominated by just five pools?

Perhaps the strongest argument to not add expressivity to Bitcoin are the irreducible risks associated with more opcodes - in other words, that covenants could “Ethereum-ize” Bitcoin. However, when rightly grasped, we believe non-linear and ephemeral fees, Bitcoin consensus, and proof of work’s (Pow) race conditions will shield it from the worst forms of entrenchment.

The floor on solo pooling (~3%) is set by energy costs and block luck. Pool size is capped by social stigma; the largest pool represents over 60% of global hashrate. Source: b10c.

Going forward, we believe certain opcodes can actually level the miner playing field, stewarding Bitcoin’s core properties and closing the door to the unhealthy expressivity being adopted.

This piece asks a simple question: will expressivity destabilize or stabilize Bitcoin consensus? To answer this question, we first establish what miners and users really need? Then, we pull lessons from both Ethereum’s history of expressivity and the last decade of bitcoin mining. Finally, we explore how new types of expressivity, including pool designs and opcodes like OP_CAT, can create a more stable and more open bitcoin for both miners and users.

What do bitcoin miners and bitcoin users need?

Miners need Feeeees

All miners need fees to stay hashing. While low fees and undifferentiated hardware implies mining is a commodity business, big miners wield real power over small ones. Big miners subsidize mining through market cycles via distinct business lines. Exchange Matrixport and miner Bitdeer are examples of this, as are ASIC maker Bitmain and mining pool Antpool.

Five pools make up 91% of Bitcoin’s hashrate Source: mainnet.observer/charts

This dynamic is driven by smaller miners leaning on large ones to smooth otherwise variable fees and results in larger miners and pools having drastic power over the Bitcoin network.

Users need a decent UX

Whereas miners are steered by revenue, users need a reliable experience. This means both the quality of transacting, as well as censorship resistance and settlement assurances of Bitcoin.

Users include DLC-powered lenders, stakechains, Metaprotocols and, of course, merge mined chains (drivechains). All users need strong inclusion and settlement assurances from miners. Designs closely tied to hashrate - including drivechains - create economies of scale in mining.

Hash-based expressivity creates a reciprocal game where users wanting inclusion send transactions solely to the miners running the expressive (but unreliable and often unverifiable) infrastructure. In this hash-based yet programmatic world, other miners can compete with their own expressivity, but feather forks, reorgs and attacks drive consolidation to the largest miners.

Phrased simply, hash-based expressivity severely degrades Bitcoin’s defining property of sovereignty by severely centralizing bitcoin mining.

What’s the alternative?

Without embracing secure, egalitarian avenues of miner revenue, Bitcoin slow walks towards PoW-based expressivity. At best, this means merge mining and metaprotocols, and at worst it means worsening stability and the eventual collapse of censorship resistance.

Obviously, some fixes (such as tail issuance) are out of the question. Our view - built on Ethereum’s history - is that opcodes can strengthen Bitcoin by injecting new forms of stability and safe forms of fee variance. The rest of this piece looks at lessons from Ethereum before using mining today to paint a picture where Bitcoin is stable on account of its expressiveness.

Vectors for Censorship on Ethereum

PBS: How and why we got here

While Ethereum aims to be “reasonably egalitarian”, excess fees are available via Maximal Extractive Value (MEV). Better flow, capital, data, and infrastructure let savvy actors grow, gaining power at all layers. Concerns over this power led to Proposer Builder Separation (PBS).

Under this design, resource heavy building (transaction harvesting and ordering) is sandboxed into its own competitive market, enabling simple and sophisticated nodes alike to mine the most profitable block. PBS aims to make block building as competitive as possible.

Ethereum MEV Today

Atomic MEV (e.g., liquidations, sandwiching, etc) is done entirely on-chain, making it more competitive. Atomic MEV involves a closed loop, all-or-nothing transaction, with capital sourced onchain. This lowers risks and barriers to entry, making it reasonably open.

In contrast, asynchronous MEV is highly rivalrous. As outlined in Flash Boys 2.0, asynchronous MEV is primarily realized in decentralized exchanges which “in fact present a serious security risk to the blockchain systems on which they operate.” MEV introduced via DEXs is defined by exclusivity and entrenchment.

Today’s block building is owned by two groups: arbitrageurs (with higher capital, better latency, propriety models, and lower fees) and those with tit-for-tat Exclusive Order Flow (EOFs) agreements. Besides PBS-adjacent research and work on buildernet, designs which dampen centralization from arbitrage or EOF are limited.

What’s the big deal?

Centralization or domination by one party at any point in the stack threatens censorship resistance of the entire network. This domination also enables verticalization and soft power across the network, potentially neutralizing the network’s foundation aim.

On Solana, verticalization of a liquid staking token to a proprietary client helps Jito dominate MEV, lowering risks, growing profits, and creating a positive feedback loop for the winning party.

Without staking or highly rivalrous forms of MEV, mining and pooling remain the largest potential avenues for verticalization in Bitcoin.

Lessons from Proof of Work Ethereum

Prior to the merge, Ethereum was defined by PoW. Once network fees eclipsed block rewards, front-running of transactions and private mining pools (with priority access) became common.

The concern for PoW Ethereum then is the same for Bitcoin today: that app incentives threaten decentralized consensus. Early researchers evened PoW Ethereum via mevgeth, a client letting any miner auction off blockspace to sophisticated parties for egalitarian revenue.

Given Bitcoin’s limited expressivity, most issues common to PoW Ethereum don’t map. However, due to ongoing expressivity debates around new opcodes, Ethereum’s primary insight of keeping mining open and limiting rivalrous economic activity is pertinent for Bitcoin.

Zooming into Bitcoin

Bitcoin’s pooling market remains understudied. Over the next halvings security will shift from issued coins to fees; to keep Bitcoin stable, mining must stay competitive and open.

What keeps Bitcoin stable?

Ethereum consensus selects proposers each epoch, delegating leaders fixed slots. This absolute monopoly over blockspace enables high extraction. In contrast, while Bitcoin miners still control blocks, the slot is not fixed and ends randomly. Race conditions from hashing nonces prompts quick transaction inclusion and fast propagation of blocks to mining peers. Said differently, with many participants, the network always races forward, stable and open.

In the case where mining consolidates due to declining issuance and/or centralizing forms of expressivity (mentioned above), Bitcoin’s censorship resistance will degrade. Users may face delays as miners ‘hold transactions’ while smaller miners simply falter. The network will be unstable, centralized, and easily coerced by 3rd party pressure.

On the flip side, PoW’s race conditions ensure that as long as mining is competitive, inclusion pressures will be strong. In our view, this means the terminal concern for Bitcoin is the sustainability, openness, and general economics of mining. All other issues, including asset sovereignty, reorgs or other attacks, and stability - are downstream of miner economics.

Basics of Mining Abuse

Today, large miners and pools skim revenue, keep templating opaque, and even conduct attacks to keep smaller miners subservient. Again, small miners solely use pools to reduce luck inherent to PoW. Within a pool, a centralized server templates blocks and pushes them to miners. ASICs hash the template for a golden nonce (valid block).

Most pools have closed source mining firmware and pay out rewards based on issuance, not fees within a given block. A few schemes are used, including:

- Pay-Per-Share (PPS): miners get less variance by earning their share of the expected value of the pool’s issuance rewards. Pools can lose money under PPS but can also grow larger by having adjacent businesses (ASIC manufacturing, etc).

- Full-Pay-Per-Share (FPPS): miners earn the PPS rewards as well as their share of transaction fees upfront (e.g., regardless if the pool found a block). Fee revenue is not auditable - fees are taken as an average and based on trust in the pool operator.

- Pay Per Last N Shares (PPLNS): miners earn fees based on the amount of hash they contribute over a given number of rounds. PPLNS pools pay only after winning a block.

There are a few deviations from vanilla mining, with Marathon running Slipstream, a notable private channel for bypassing mempool standards and Ocean offering open templating to users.

Outside of Slipstream and Ocean, pools primarily use FPPS. Attempts to use others have failed, as lower per-hash revenue harms miner economics and centralizes Bitcoin. Looking ahead, miners will need visibility into templating as fees become more critical to their businesses. To keep Bitcoin stable and decentralized, smaller miners will need a competitive yet auditable pool.

What’s the shape of Bitcoin fees?

Currently, Bitcoin has low fees. Most blocks are empty or simply contain vanilla UXTO spends or inscriptions. When fees do exist, they are ‘spikey’, making network fees match a Pareto distribution (this contrasts to networks with DEXs, which have Poisson distributions due to frequent arbitrage or EOF; for more see Neuder et al).

In an environment with regular demand (fees), there is a low incentive to reorg since the next block also has fees. However, deployments of new contracts, ordinal mints, or general volatility (e.g., an exchange collapse) can cause huge fee spikes, incentivizing reorgs.

While Nakamoto consensus will eventually finalize, it’s likely miners privately mine large fees and attempt to reorg Bitcoin to steal high fee blocks from other miners.

Fee spikes during Babylon’s launch. Source mempool.space

In either case (e.g., regular fees or low average fees), spikes in demand will lead to hashrate consolidation as users will increasingly rely on larger miners and pools, driving small miners to work for larger ones (alternatively, reorgs could drive demand to transact lower and lower, leaving only larger, well-capitalized miners to run the network).

However, in our view, spikey fees could still one day be captured by smaller miners, lessening entrenchment. Specifically, under the right payout and accountability scheme small miners can band together to give users better settlement assurances than larger solo ones. The next two sections lay out this thesis.

Can and will mining pools share spikey fees?

As mentioned above, small miners today rely on big miners and/or pools for fees. Designing an open or egalitarian pool which ensures fees are split fairly is hard without auditability. While Bitcoin has and will avoid most forms of unauditable fees (e.g., arbitrage, private order flow), some types of transactions - like out-of-band payments - remain unauditable.

In theory, pressure from rivals could induce even fee sharing, but in practice, bad data, switching costs, and verticalization pushes small miners to trust large ones. Without a way for small, individual miners to provide superior inclusion and settlement guarantees, unauditable transactions will mainly route to larger miners and pools, centralizing Bitcoin.

What could stabilize Bitcoin consensus?

One potential fix is tacking accountability onto a federated pool. Accountability brings economic finality, lowering re-org risk and improving user guarantees. Critically, miners can still mine outside this pool with BitcoinCore, ensuring liveness is preserved and letting the network progress and be validated by as many participants as possible.

In this model, miners split fees and provide joint accelerated yet accountable access to Bitcoin. Users would submit to this pool over a private one like SlipStream due to its re-org resistance and access to more miners, yielding higher inclusion and confirmation guarantees. While solo channels for nonstandard or vulnerable transactions can persist, mixing race conditions with economic accountability would yield a more decentralized yet competitive alternative.

Since finality is a useful property for financial apps and improves with more parties contributing to it, this pool will see a high percent of network transactions, making it competitive. Accountability between its agents will create fairer economics, driving rival pools to share fees as well. In a word, we believe new expressivity, including designs bringing economic finality, can help stabilize Bitcoin, quelling worries over network security and keeping mining open.

Having looked at mining, the piece turns to how new expressivity may impact Bitcoin.

Poolin’ in OP_CAT’s World

There are many proposed softforks which bring expressivity back to Bitcoin. Using an OP_CAT powered AMM, we analyze how expressivity could alter Bitcoin

Note: an Automated Market Maker (AMM) is a mathematical function which powers trading on blockchains. AMMs are the main cause of highly rivalrous MEV (or MEVil). Much of the writing in this section draws from Unity is Strength and Balrogs and OP_CATs.

Scenario 1: no AMM is unlocked from a softfork

In this scenario, the network would not face the perils of highly rivalrous MEV (e.g., arbitrage and EOF agreements). Without an AMM, most MEV would be atomic or one-off. While miners can verticalize, most transactions will be widely broadcasted, keeping mining competitive.

Scenario 2: OP_CAT powers a weak AMM

In this world, a softfork unlocks a native Bitcoin AMM. Due to variance in Bitcoin’s block times, bad prices are systemic as stale orders are re-orged or filled. Additional complex attacks along with more performant alternative trading venues will ensure the AMM receives little use.

Traders may trade natively for ideological or memetic reasons, but without substantial changes to Bitcoin, no AMM will be durably used or create a highly centralizing MEV.

Scenario 3: an OP_CAT softfork powers a widely used AMM

While the world where Bitcoin hosts its own popular DEX seems unlikely, it is worth considering. In this world, arbitrage and EOF help aggregate hashpower into a large pool. The high reliability of the larger pool and exclusivity of both types of MEV would create a symbiosis between the miner and extractor, making them one. Most miners would have to join this pool or go under.

However, since Bitcoin is predicated on decentralization, this miner will face limits to growth. Moreover, with luck, other miners could sometimes still outrace the pool. Needless to say, though, while a popular Bitcoin AMM would bring fees, it would markedly harm Bitcoin.

Again, even if an AMM is feasible with OP_CAT, it would be very limited and re-org risk, random block times, and bad prices would dampen use. To cite others, “there’s no such thing as a long block time & high mevil blockchain” (for more, see The Spectre of MEV on Bitcoin).

Other issues with opcodes

Beyond potential risks associated with an AMM, other risks and attacks are worth highlighting. Mapping all risks a priori is impossible, but it’s important to note upgrading Bitcoin may induce, introduce, or even limit attacks further. Possible contenders include:

- Selfish Mining: miners can withhold valid blocks, earning more revenue. Recent work extends this ‘mining cartel’ or ‘timing game’ beyond issuance to fees, concluding selfish mining is more profitable for miners with less hashrate. Attacks can be worsened by slow blocks and non-uniform block propagation times. With more expressivity, it stands to reason block withholding could become more popular.

- 51% attack on optimistic rollup: 51% of hashrate can be used to attack optimistic rollups and BitVM style bridges. A well-capitalized attacker could even rent hash and short BTC futures to profit. Any attacker would need lots of ASICs and to forgo mining revenue. New opcodes - such one for zk-verification - can actually limit this attack.

What should we think about other opcodes?

Beyond OP_CAT, there are a host of ways to softfork Bitcoin. Whether for Lighting, Ark, covenants, discrete log contracts, or something else, opcodes like OP_CTV, OP_VAULT, and others can unlock expressivity, utility, and miner fees. But should Bitcoin embrace expressivity?

Again, without improved economics, miners will be forced to embrace merge mining or rely on bigger ones with external, opaque businesses. While fears over Ethereum’s struggle with MEV are valid, issues on Ethereum are not automatically disqualifying of expressivity on Bitcoin.

Rather, given Nakamoto consensus is inhospitable to AMMs and that Bitcoin’s default is low fees and poor miner economics, the bar for opcodes which grow demand shouldn’t be high.

Most expressivity - such as a BitVM chain or a Bitcoin rollup - will benefit security. So long as new opcodes don’t create economies of scale, exclusivity, or attacks, embracing expressivity and fees will create stability. Of course, no fork is perfect, but many softforks offer unconventional ways to smooth revenue and stabilize Bitcoin. A few ideas include:

- Rollup: a trustless and verifiable sidechain, a Bitcoin rollup would pay for data, as well as finality. Miners can build their own rollups or work jointly. While one miner could dominate, geographic frictions suggest multiple will exist. With better opcodes rollups can be fully noncustodial, making it superior to alternates (e.g., FTX). Miners could offset PoW mining periodically with rollup profits.

- Decentralized exchange: with a SNARK verification opcode, miners could jointly operate and settle a BTC exchange off-chain, sharing fees. While this will result in MEV being ‘sandboxed’ above Bitcoin, different jurisdictions likely will have different exchanges, limiting complete horizontal and vertical integration.

- Payments chain: statechains or designs like Ark will pay fees to miners. Miners should earn decent fees from a large-scale payment network due to the repeated costs and geographic sharding needed to scale payments. By making these systems safer with new opcodes, demand for Bitcoin payments can be induced, increasing fees to miners.

Again, any of these designs will need better finality assurances as issuance declines, meaning a diverse group of miners should be paid for finality in perpetuity.

The Mining World of Tomorrow

The inability of miners to act independently of or verify large pools suggests pooling will radically change as issuance declines. Without fees from useful applications on-top of or attached to Bitcoin, hashrate will tumble and consolidate, causing network instability.

In our view, this makes safe expressivity and egalitarian fees a critical pursuit. Should expressivity grow, verticalized miners across distinct geographies will be best equipped to survive as issuance dwindles. And with advancements in accountable pooling, apps, rollups, and others can bid for finality, giving miners real economics in the products they secure. In return for fees, miners can stabilize bitcoin, keeping today’s most pristine crypto asset open.

Going forward, we expect to see a market somewhat similar to Ethereum’s mevgeth to evolve. Under this market, bundles of transactions with ‘spikey revenue’ (e.g., ordinals mints, data from rollups, etc) can be submitted to miners or pools. The degree of openness of this pool to ordinary miners along with its accountability could in many respects determine Bitcoin’ durability.

Tail issuance, rejecting nonstandard transactions or other expressive revenue from softforks, nor private channels are an answer to Bitcoin’s dwindling security budget. Embracing safe expressivity and inducing demand for Bitcoin blockspace can help the network mature.

If Bitcoin wants to cross the chasm from digital store-of-value or gold equivalent to electronic peer-to-peer cash, opening the door to utility which unlocks even-handed satsflow to miners is critical. So long as expressivity unlocked by a softfork is not exclusive or entrenching, fees will be reasonably open and smooth for miners, allowing bitcoin’s unique scarcity to compound into a digital medium of exchange via its own applications and trust-minimized sidechains.

Failure to evolve expressivity implicitly embraces less worthy forms. Without reliable miner fees, less secure, less sustainable, and less democratic forms of expressivity will proliferate among the biggest miners, while smaller ones simply close shop.

Special thanks to Salvatore Ingala, Hasu, Data Always, Jeremy Rubin, Eric Wall, Gwart, Will Foxley, Janus and members of the Standard Crypto team for reviews and discussions of early drafts of this piece.