Staying Sober on Stables

on

Stablecoins have famously been called room-temperature superconductors for financial services. Instant, borderless, and nearly free, stablecoins move value as easily as bits. But plug them into the legacy financial system, and these superconductors lose much of their super power.

Their handicaps – burdensome on and off-ramping, lack of chargebacks or compliance tooling, and limited spendability, to name a few – dampen their value. Despite their drawbacks, stablecoins found product-market fit in cross-border B2B, B2C, and C2C payments, where legacy financial infrastructure is especially weak.

The quality and accessibility of stablecoin infrastructure will improve as more users come on-chain. Not only will on and off-ramping become easier, but the need to off-ramp at all will lower as stablecoins become more widely accepted. Stablecoins’ valuation proposition strengthens as adoption grows; they have a network effect.

Excitement about stablecoins has grown alongside their supply, which now exceeds $250B. The market’s latest inflection was Stripe’s acquisition of Bridge, which legitimized stablecoins and pulled forward latent demand from crypto-cautious businesses. Other fintechs have fast-followed with their own stablecoin strategies.

We share the stablecoin enthusiasm: when a new technology finds product-market fit in a massive market, tremendous value soon follows. But we have trepidation about how and where that value will flow long-term.

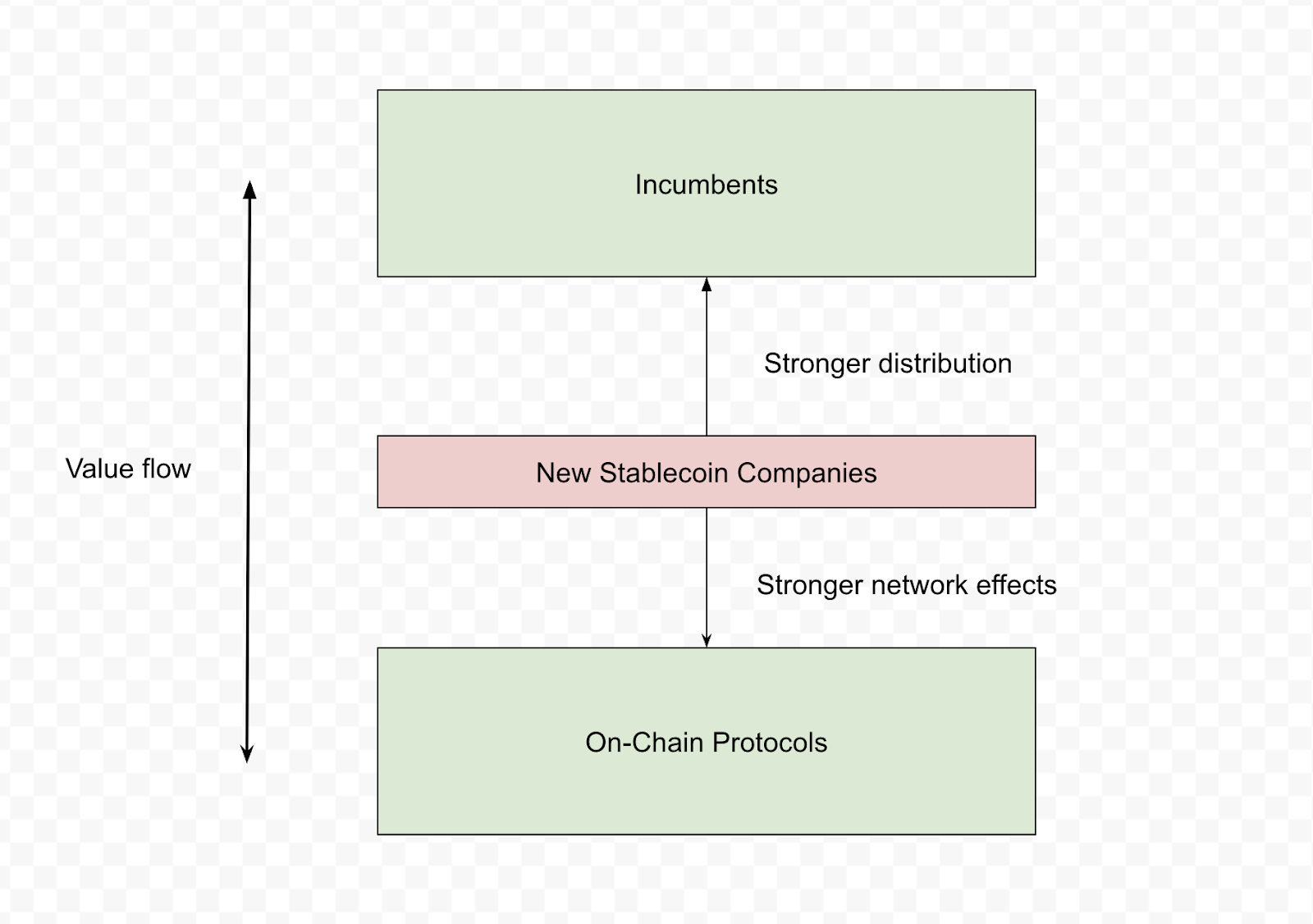

The crux of our view is that the value created by stablecoin growth will primarily accrue to incumbents and on-chain protocols, rather than new stablecoin companies.

Stablecoins are primarily a sustaining innovation

Think of a new market as a gold field. The gold is the value to be captured in that new market. When gold is discovered, new players flock to the field in pursuit of it. There are 3 main factors which influence how much of that gold is captured by new players versus better-resourced incumbents:

- How much gold incumbents believe there is - If incumbents don’t believe there’s enough gold to mine, they may wait for the size of the opportunity to become clearer. This gives startups the chance to find gold and accumulate resources before incumbents enter the market.

- Knowledge about where the gold is - If the market doesn’t know where the gold in the field is, startups may search faster or in different areas, finding gold before the incumbent.

- How dispersed the gold is - If all the gold is concentrated in a small area, it’s more likely that only a few winners will emerge. By contrast, if it’s spread throughout the field, there may be more winners.

New technologies provide openings for startups when they are ignored, have undiscovered or underutilized use cases, or when the technologies’ applicability is broad, such that incumbents can’t capture all the gold.

So how do stablecoins fit into this?

- How much gold incumbents believe there is - Despite being in the early days of stablecoin adoption, incumbents – who we classify as everyone from late-stage crypto companies to legacy Fintechs – are already in the market. Stripe, Nubank, Moneygram, Mastercard, and Visa all have stablecoin products.

- Knowledge about where the gold is - The first decade of stablecoins was spent proving product-market fit. Now, we know the problems they solve. While use cases will expand with adoption, incumbents are not only tracking, but in some cases pioneering those applications.

- How dispersed the gold is - For now, stablecoins are primarily for cross-border payments. While that market is huge, it is not broad, limiting the diversity of businesses that can be built. The gold is concentrated.

In summary, incumbents recognize how large stablecoins will become, and understand the set of problems for which they’re well suited. This market structure provides limited opportunities for new startups. It stands in contrast to horizontal technologies like the internet or AI, which re-shape thousands of markets. For example, we can build AI businesses for everything from auto dealerships to law firms.

This is not to say that some stablecoin-first companies won’t succeed. Businesses that have already built up some distribution, like Tether, Circle, or Yellowcard, may be able to fend off competitive pressures. The challenge is for stablecoin businesses starting today: without distribution or a highly differentiated product (for which stablecoins provide limited potential today), what is their wedge and path to defensibility?

It’s hard to know ex ante how much hidden gold a market has. But by its current market structure, we believe the stablecoin market has lots of gold, yet relatively little that is hidden. If that is correct, then the best time to start a stablecoin company may have been years ago, before incumbents aggressively entered the market, before the amount and location of the gold was widely identified.

Stablecoins will deepen the moats of some on-chain protocols

Incumbents will be a major beneficiary of stablecoins; we believe on-chain protocols will be another. Protocols with network effects, particularly liquidity network effects, will see their moats strengthen as more stablecoins come on-chain. Lending protocols like Aave, CDPs like Sky, and future on-chain FX markets are all examples.

Aave will get deeper pools, which lets borrowers pay less while depositors and the protocol earn more. Sky’s vaults can mint more USDS with steadier collateral, simultaneously strengthening its peg and growing its revenue. FX venues can quote tighter prices because they’ll have larger, better-matched reserves. These protocols become more useful products and more profitable businesses with scale. Competitors can easily replicate their code, but not the liquidity which makes them so efficient.

Many protocols risk getting disrupted by incumbents. Stablecoin payment service providers could commoditize blockchains by abstracting over any layer. With enough payment flow, they could even disintermediate existing networks and insert their own. These shifts in market share among blockchains will have downstream effects on the protocols on them. Those that are able to stay relevant and grow alongside stablecoins will become much larger.

Conclusion

Unlike the early fintech businesses of the 2010s, stablecoin companies must compete against a fast-moving, tech-savvy incumbent class with a distribution advantage. A lot of the value from stablecoin adoption will be absorbed by those incumbents.

In our view, the stablecoin businesses with the strongest potential for sustained competitive advantage are on-chain protocols with liquidity network effects.

Even if most value accrues elsewhere, there remain new stablecoin companies to build. Given the size of the stablecoin opportunity – cross-border payments alone are projected to reach $290 trillion in volume by 2030 – there could be multiple new billion dollar businesses. Beyond stablecoin-related protocols, one category of startups that we believe will be successful are regional stablecoin service providers. These businesses have local expertise and distribution that’s difficult to replicate. Other opportunities may exist for startups powering micropayments or inter-agent finance.

If you’re building a stablecoin business, or an on-chain protocol that supports them, we’d love to chat. My email is nick@standardcrypto.vc.