Finding A Way Through Bulls and Bears

on

Our Investing Philosophy When It Comes To Crypto’s Rollercoaster Ride

We can totally understand why newcomers to crypto may be feeling a good bit of whiplash. Weren’t we just riding high, not so long ago? And now not so much.

My co-founder, Adam, and I have been in the space since 2012 — long enough to actually experience several cycles. I’ll never forget how I felt when Bitcoin tumbled down from its 2013 adrenaline high of ~$1000 to its 2015 heart-rending low of ~$200.

That moment in time parallels recent events as well. Back in 2014, crypto had an 80-percent-plus drawdown in asset value; a high-profile exchange self-immolated with depositors forced to wait out a lengthy legal process; the media flipped from optimistic to all-negative-all-the-time; and there was an overall feeling of not knowing what was next. The grand crypto experiment was officially over. Sounds familiar, right?

Except it wasn’t over then. And it isn’t over now. A key lesson that we’ve internalized is that a deep historical perspective keeps you grounded. It takes courage to work on crypto when the world is telling you that you’re throwing away your career.1 Courage comes from thinking long-term, with an understanding that the values and technologies crypto is introducing into the world are on the right side of history. So even during the height of the bull markets, we’ve counseled our founders to take a breath. And, during the lowest of the lows we’ve counseled our founders… to take a breath.

To that, I think it is worthwhile to better understand Standard Crypto’s investing philosophy through some of this historical perspective. Every quarter, we send out a letter to our Limited Partners (LPs) covering key topics and trends in crypto, and how we are approaching the sector. Below, you’ll find lightly edited excerpts from both the spring of 2021 when the scene was on fire (in a good way) and then an excerpt exactly one year later when the ecosystem was also on fire… in a much less good way.

Our hope is that it helps us all take a much needed breath.

Excerpt from May 15, 2021: The Bull

To our Limited Partners:

Over the past quarter, we've observed a powerful shift in the perception of crypto's inevitability. The question is no longer "will crypto endure?" Rather we hear: “How will crypto fit into our economy?", "How big can it be?", and "How will it play out, and when?"

Markets are reflexive and perception alters reality. The floodgates of talent and capital have opened up. Minds are open to change. Welcome to the newest crypto bull market.

Navigating a bull market

For us, this is now our 4th crypto bull market (2011, 2013, 2017, 2021). While each cycle has its unique qualities, there are lessons we've learned over the years (some painfully!) that guide how we navigate today's environment.

- Avoid incremental improvements — Incrementalism is a tell for opportunism. The goal is and has always been to find category defining startups who offer order of magnitude improvements to the status quo.

- Distinguish between hype and product-market fit — Retail investor prevalence and thinly-traded markets in crypto inevitably lead to availability cascades where some tokens trade on the basis of their meme rather than their value creation.

- Maintain price discipline — Lower cost bases improve returns and manage portfolio risk. We have to play the game on the field which will certainly involve higher prices than a year ago, but we need to pick our spots carefully.

- Entrepreneur quality is True North — We will win if we continue to partner with the best founders and communities in the space. We want to keep the bar high.

Excerpt from May 16, 2022: The Bear

To our Limited Partners:

We live in interesting times. 2022 is an inflection point, broadly. Crypto’s near-term fortunes are being shaped by broader market dynamics, which now include war, monetary tightening, and the risk of recession on top of inflation, COVID-19, and economic slowdown.

We are no stranger to bear markets. This would be the fourth crypto bear market we've experienced first-hand. Experience doesn’t make seeing red on the charts feel better, but it does inspire the poise to focus rather than panic. While each bear cycle has its unique flavor, we are emboldened by the instincts we’ve developed over the years to identify the trends and investments that transcend short-term cyclicality.

Crypto and Productive Bubbles

Financial bubbles occur throughout history across industries and civilizations. While most bubbles leave behind little more than a historical footnote, economist/investor Bill Janeway argues that: “Occasionally, financial speculation fastens on to a transformational [technology] that has the potential to create a genuinely new economy.” Janeway terms this a “productive bubble” where a speculative environment capitalizes the R&D of technology that will ultimately bear valuable fruit but otherwise wouldn’t have been funded.2

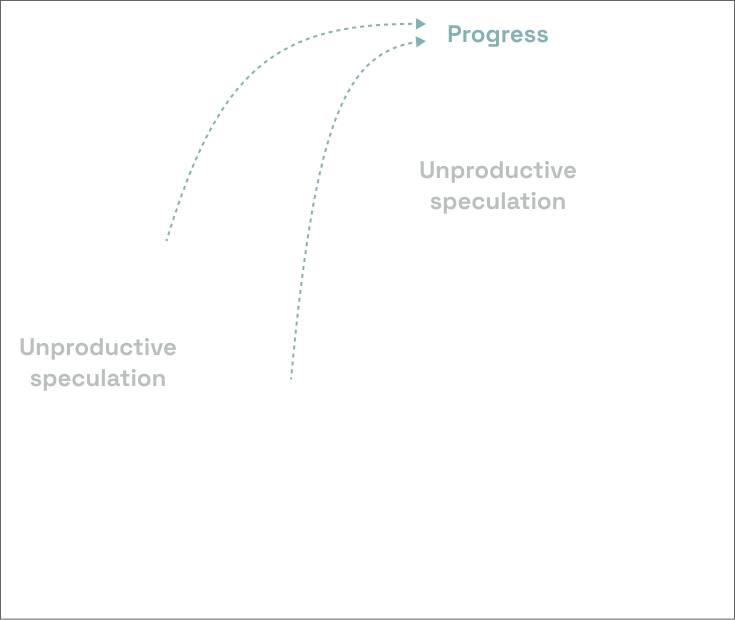

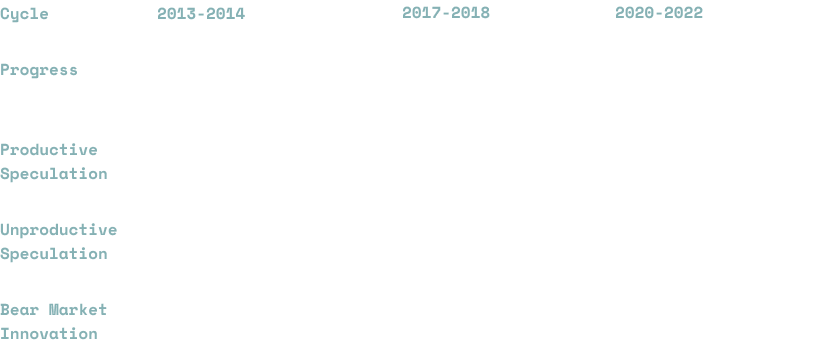

We are students of Janeway and find his lens instructive as we invest across cycles in crypto. We believe that a crypto cycle can be decomposed into four components:

- Fruit borne from productive speculation in the prior cycle

- Productive speculation in the current cycle

- Unproductive speculation in the current cycle

- Innovation occurring during a preceding bear market

We’ve seen this unfold across all prior cycles and we foresee it playing out into the future as well:

Our investment strategy is shaped by this perspective. In bull markets, we fund category leaders with strong fundamentals/momentum (e.g. OpenSea) as well as forward-looking entrepreneurs building what will become linchpins of the next era (e.g. Limit Break) while setting aside dry powder in anticipation of the cycle’s conclusion. In bear markets, with reduced investor competition, stronger entrepreneur quality via self-selection, and lower entry prices, we carefully pick our spots but act with conviction and optimism.

It’s worth expanding on the bear market investing dynamic and what we currently expect based on past experience:

- Tourist VCs will leave. We’re already seeing “.eth” removed from Twitter handles and “all-in on Web3!” investors starting to look at AI deals. At generalist firms, broad partnership support for crypto will turn to default skepticism. The best crypto investors at non-crypto firms will eventually leave, as they have in the past.

- Opportunistic entrepreneurs will lose conviction. That Facebook PM who will now get a raised eyebrow instead of a high-five from his co-workers for getting into crypto will retreat back to his/her comfort zone. Those who remain are the true believers and exactly who we want to partner with.

- Crypto fund “one-hit wonders” will shut down. Every cycle, a cohort of crypto funds emerges perfectly tuned to resonate with the specific dynamics of that particular cycle. In 2017, it was funds focused on ICO flipping. This time, it could be overly-narrow DeFi or NFT funds. We’ll find out soon enough.

- Entrepreneurs gravitate towards substance over style in their VC partner. Company building skill and legitimate value-add will matter, not the number of Twitter followers. Quality crypto-native VCs will enjoy a more thoughtful courting process and more pricing power.

- Temporarily distressed liquid assets will be at attractive entry points for venture-scale returns. Launched protocols with live tokens have already eliminated a substantial amount of execution risk. A pessimistic market backdrop will allow the selective investor to identify strong contrarian-and-right opportunities.

Suffice to say, we face the coming market conditions with enthusiasm and confidence in our approach.

Our Guidance to Entrepreneurs

While crypto’s cyclicality is now second nature to us, many of the entrepreneurs we partner with are going through their first bear market. We wanted to share with you the guidance we often provide to the founders in our portfolio.3

The only way to win in a bear is to live long enough to experience the next bull. Cash is king; keep burn rates low and manage your treasury conservatively.4 Your competition running out of money is a great way to gain market share.

Hard times harden communities

Retail speculators are not high quality community members. When the tide goes out, those who remain do so with conviction. Focus on serving and encouraging those core users. They, like you, are visionaries who see greatness on the horizon.

Governance crises bring clarity

Everyone gets along when the pie is growing. Scarcity breeds in-fighting over a conflict of visions. Lean into the tension and know that overcoming a governance crisis is a rite of passage on the path to success. Yes, you’ll lose a portion of your user base and possibly see a direct competitor born, but you’ll gain a refined sense of purpose and likely deepen your product-market fit. Bitcoin was ultimately strengthened by the Bitcoin Cash fork; Ethereum by Ethereum Classic; Cosmos by the dissolution of its foundation; Uniswap by Sushi; etc.

The “steroid era” is over

Greed has transformed into fear. Your token won’t go up by default. Airdrops, liquidity mining, and other token incentives will not make up for a lack of product-market fit. Create value for users sustainably and the rest will follow.

“In theory” becomes “in reality”

Every protocol design has tricky corner cases and failsafes in case of duress. Expect every corner case to be explored and every failsafe to be stressed. Bull markets provide social and economic margins of safety for crypto-economic mechanism designers. Bear markets separate the well-designed and thought-through from the rest.

Call your shot

There are no more waves to catch in hope of rapid growth. You are generating the wave yourself. Have a strong point of view on how the future should play out and violently execute in pursuit of it. Let your vision today be tomorrow’s meme.

Don’t lose faith

Things are never as bad as they appear. Find encouragement in your friends, family, and those of us that are here to stay. Lean on us — we are your partners in good times and bad.

Crypto is Inevitable

As another cycle wanes, we can’t help but reflect on how much progress has been made. At the conclusion of each cycle prior, the predominant question was “will crypto survive?” We, as an industry, have answered that question with a resounding YES. Today’s skeptics ask “when?” and “how?” but no longer “if?” Crypto has millions of users, manages billions of capital, and has captivated the minds of entrepreneurs who wish to build a future for the internet that improves on our status quo. There will of course be bumps in the road and not every idea will work. But survey any astute observer of technology, and you’ll find (a perhaps reluctant) acknowledgement that crypto will help define the next era of progress.

And… Bringing Us to Today

We think the 2023 bear is starting off in a better place than any bear crypto has previously experienced. There is an abundance of blockspace with a variety of tradeoffs,5 a number of proven business models for decentralized networks, a long list of ideas to revisit that showed promise but were too early or require further tinkering (e.g. crypto games), a handful of game-changing infrastructure breakthroughs primed for productization (e.g. ZKPs), and, once again, the safety blanket of relative obscurity to focus on wowing users.

We have a general framework for where we look in bear markets:

- Pre-existing category leaders poised to consolidate market share as their weaker competitors suffer (e.g. DeFi protocols with strong network effects and liquidity)

- Reconstituted versions of earlier concepts that struck a chord but had design flaws or were too early (e.g. crypto-powered games)

- Startups leveraging recent inflections in technology/infrastructure (e.g. zero-knowledge proofs)

We also think it is worth elaborating on some patterns that we try to avoid: (1) ideas that assume specifics from the last cycle will repeat themselves and (2) a “retreat” to apps/infrastructure aimed at reducing friction as opposed to enabling new use cases.

Many of the entrepreneurs we meet continue to pitch us ideas that could have been plausible 1-2 years ago during the bull market, but not now. Building momentum from scratch takes a fundamentally different approach than surfing a pre-existing wave. If a new startup assumes business as usual (or even a return to business as usual), we likely won’t invest.

Another situation we frequently encounter is one where a crypto startup’s goal is to reduce friction. We think this premise is usually flawed. One of the tried-and-true heuristics in venture is that great companies see their product adopted in spite of its rough edges and friction. The best products are magnets that pull in users even though the experience is initially painful. The same applies in crypto, for both infrastructure and applications.

A common chain of logic we hear is “X was a breakout app/protocol. If we remove the infrastructure friction for developers to build more apps/protocols like X, we’ll see many more X-like successes and we’ll be able to make money along the way by enabling them.” There’s a parallel for applications where solving UX friction is the startup’s goal. The premise here is that crypto’s existing use cases are good enough for mass appeal but the bottleneck is clunky/complicated software or that the “crypto elements” need to be abstracted away from the user.

We tend to reject this premise for reasons analogous to those we made for infrastructure. We believe the opportunity in crypto is for entrepreneurs to push the boundary of how crypto is used and what it’s used for, not to take what’s already done and “simplify” it. Compelling use cases will attract users regardless of the UX friction. Create value for users and they will come.

In short, crypto marches on and those with the gumption to will it into its next era will find the reward well worth it.

🌎 🧑🚀 🔫 🧑🚀

- In 2016 a mentor of mine did, in fact, tell me that I was “throwing away my career” by focusing on crypto.

- "Doing Capitalism in the Innovation Economy: Markets, Speculation, and the State," Bill Janeway (2012).

- The entrepreneur is the intended audience.

- Managing burn is less of an issue in crypto since crypto startups are fundamentally more capital efficient than typical tech startups (minimal infrastructure/maintenance costs if built on a blockchain; users pay transaction fees; communities provide leverage on distribution rather than costly sales/marketing).

- Tradeoffs for blockspace include economic security, transaction speed, execution environment, etc.